E-commerce: the positive trend of the Italian online market continues in the summer quarter. These are the data collected by Blendee. Let’s look at them together in detail.

What many had already speculated in recent months is probably happening: the spread of the Covid-19-related pandemic and the ensuing lockdown period have irreversibly changed our buying habits and modes, greatly accelerating the digitization process.

Research published last August by CNBC and carried out by Salesforce reports how online shopping globally grew by 71 percent in the second four months of 2020, a trend also confirmed by a study conducted by the British Office for National Statistics, which reveals how the number of online sales related to the total retail sector increased from 18.7 percent in July 2019 to 28.1 percent in July 2020. So if on the one hand more and more companies and brands are choosing to invest exclusively in the digital sphere, on the other hand, it is precisely the latter that represents a lifeline for many realities hitherto anchored to the retail world.

But what happened to many sectors of the Italian market in the period immediately following the end of the lockdown? Are trends and growth data recorded during the peak phase of the pandemic being confirmed?

To provide us with an answer, data from Blendee’s E-Commerce Active Monitoring Observatory , which, pursuing in the analysis started last March, this time focuses the time frame of reference to the period immediately following the end of the lockdown in our country, from June 15 to September 15, in order to investigate the performance of the eCommerce sector during the summer period.

- Trends in commodity sectors

- Has the Covid-19 pandemic changed the purchasing behavior of Italians?

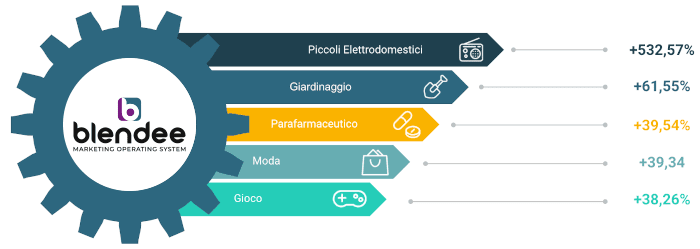

Trends in commodity sectors: summer quarter data

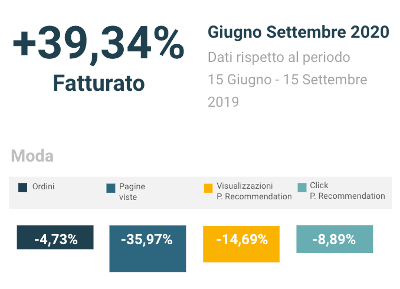

Research conducted by IBM in the U.S. marketplace clearly shows how the pandemic has redefined the categories deemed essential by consumers by bringing to the fore merchandise categories related to groceries, alcohol, and DIY, at the expense of categories that have always been deemed prominent in eCommerce such as accessories and clothing.

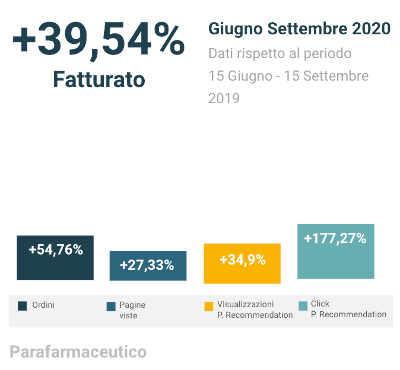

From Blendee’s data concerning marketing automation activities in the period June 15-September 15, significant growth is confirmed for the pharmaceutical and parapharmaceutical sector, which marks a +39.5 percent compared to the same period last year in terms of revenue and excellent performance also in terms of online interactions: +27.33 percent of page views compared to the previous year, +34.90 percent of product recommendation views and +177.27 percent of clicks.

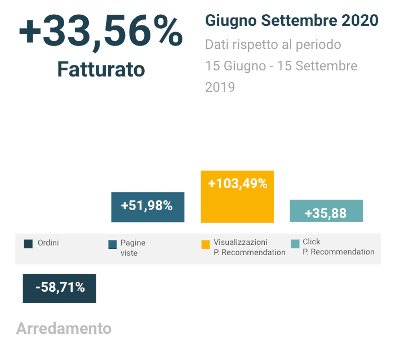

+33%, compared with the previous year, for the turnover of realities related to the world of furniture which also marks positive data in terms of performance related to views (+103.49%) and clicks(+35.88%) of recommended products.

+33%, rispetto all’anno precedente, per il fatturato delle realtà legate al mondo dell’arredamento che fa segnare dati positivi anche in termini di performace relative alle visualizzazioni (+103,49%) e ai click(+35,88%) dei prodotti consigliati.

Still positive, but undoubtedly less impactful, is the growth of the superfood related to the sale of supplements and products for the health and well-being of sportsmen and sportswomen: turnover reached +9.8 percent and the number of orders +19.44 percent, compared with the same period last year.

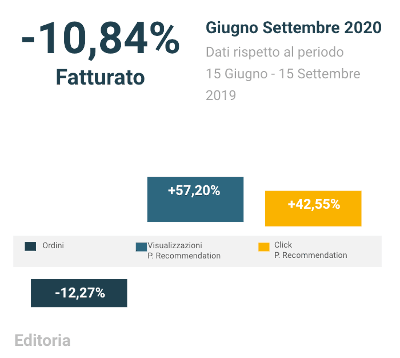

Bucking the trend, however, compared with last year, the sector of online publishing, whose turnover in the June-September 2020 period marks -10.84% compared to the same period last year, despite an increase in views (+57.20) and clicks (+42.55%) on recommended products.

Analysis of data for the June-September 2020 quarter also shows positive growth for the small household appliances sector.

Users continue to buy both home and personal care tools on the web, registering an increase in the number of orders by 59.14% and in sales by 532.57%, compared to the same period last year.

Also increasing are page views with +57.79% and conversions with +15.07%. Also positive are data on views (+31.30%) and clicks (+17.91%) of recommended products.

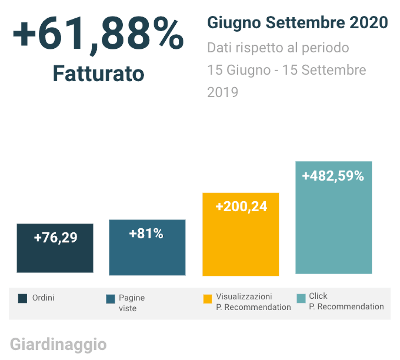

Also for the gardening sector, data collected at the end of the summer indicated a remarkable growth in eCommerce sales compared to the same period last year. In fact, an increase of 61.88 percent in the number of orders and 76.29 percent in sales is calculated.

Also interesting is the data on recommended products of which there was a 200.24% on views and a 482.59% on clicks, as well as an overall increase in page views of the site of 81%.

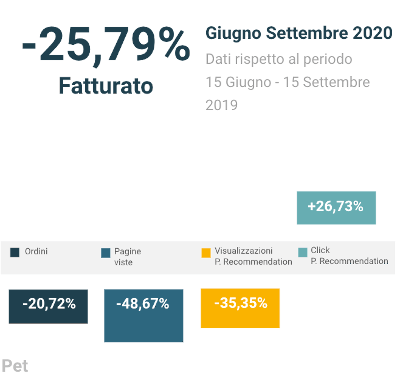

Contained, however, were the results in the pet sector, where in the summer post-lockdown period, there was a decrease in sales (-25.79%), despite an increase in conversions (+54.43%) and clicks on recommended products by 26.73%, compared to the same period in 2019.

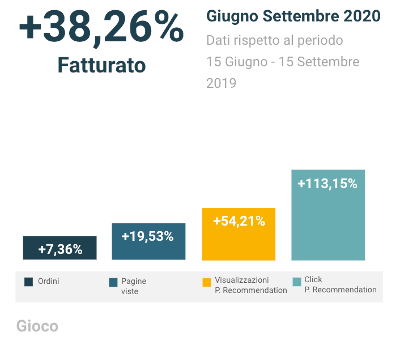

Finally, a pleasant revelation came from the analysis of data from the games sector, which ended the summer quarter by marking +38.26 in orders and +7.36 percent in sales compared to the same period last year. Of no less significance were the results related to the product recommendations, of which views increased by 54.21% and clicks by 113.15% . Also on the positive side were page views on the site with +19.53%.

Has the Covid-19 pandemic changed the purchasing behavior of Italians? Let’s find out by analyzing the data

Data collected in the summer quarter, confirm the trend of Italians to buy online.

Obviously, making a comparison with the spring quarter, corresponding to the lockdown, the summer figures are down. This is easily explained by the fact that from March to May, there was a real inability to go to physical stores, and thus online shops were an almost forced choice.

Comparison with the same period last year, on the other hand, shows how people, once the restriction period has passed, continue to buy on the web even if physical stores are open, having become familiar with the eCommence world.

Given this, it is crucial for companies not to neglect the online world and to adopt omnichannel marketing strategies in order to personalize the user experience and push the customer to choose the brand.